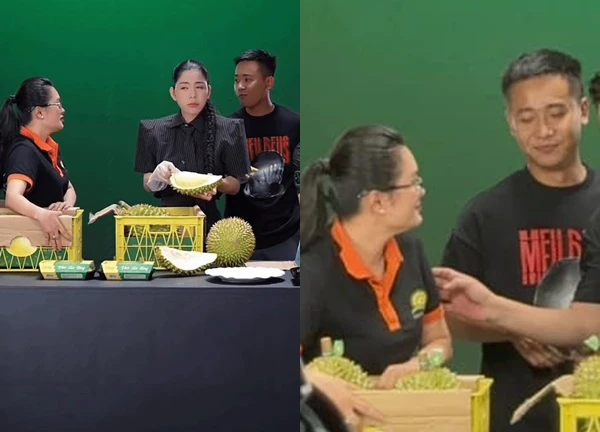

Hang Du Muc encountered a problem on the livestream and was too upset to "argue" for justice

3 | 1 Discuss | Share

A series of popular tiktokers, war gods who closed orders on livestreams such as Quang Linh Vlog, Hang Du Muc have just been called names, related to the police and taxes. Although they are not wrongdoers, when it comes to livestreaming, both are also mentioned.

Recently, on the TikTok Shop platform, livestream sessions with revenues from a few tens to hundreds of billions of VND were recorded of famous TikTokers such as Quang Linh Vlogs, Hang Du Muc, Quyen Leo Daily, Pham Thoai, Ha Linh... The explosion of sales livestream sessions with "huge" revenue is because the sellers are all celebrities and influencers on the TikTok platform that many people claim to be "idols".

Fans buy goods on the livestream mostly to support their idols. Therefore, items that seemed to be only sold offline have crept online such as durian, fruits, or even cars and motorbikes.

In addition to celebrities, most sellers on social networking platforms also practice getting used to livestreaming in parallel with selling directly through booths, making this market even more explosive.

Cult sales livestream sessions with hundreds of billions of revenue take place on TikTok Shop, but this platform will not interfere with sales activities, sharing the revenue of TikTokers with brands.

TikTok Vietnam said that the agreement on how the commission % of each product is sold is up to the livestreamer and the brand and platform will not intervene. The seller's commission when livestreaming will be based on the contract with the label and will have to declare for rent with the profit earned from online sales.

According to regulations, online sellers on platforms will have to pay value-added tax (VAT) and personal income when the revenue is from 100 million VND/year.

In particular, sellers who are individuals whose revenue is commission from livestream sales must pay personal income tax according to a progressive tariff with 7 levels, the tax rate will range from 5-35%. For business households, the commission when livestreaming sales will have to declare and pay tax at the rate of 7% including: 2% personal income and 5% VAT.

According to Lawyer Diep Nang Binh - Head of the Law Firm of the Law Department, business individuals must register for tax within 10 working days from the date of commencement of business activities. Depending on the time of delay in submitting tax declaration dossiers, violating organizations may be subject to warnings; a fine of between 2 and 25 million VND.

In case the violator evades to declare and pay tax, he or she may be fined from 1 time to 3 times the evaded tax amount and forced to remedy the consequences of being forced to pay the full evaded tax amount into the state budget.

In the face of the explosion of livestream activities on exchanges, the General Department of Taxation has just issued Official Letter No. 3153 on strengthening tax management for e-commerce activities.

Specifically, the General Department of Taxation stated in the official dispatch that over the past time, the tax administration for e-commerce business activities has achieved remarkable results.

In order to continue effective tax management for e-commerce activities, the General Department of Taxation directs the Tax Departments of provinces and cities to strengthen inspection and examination of business organizations in the field of e-commerce, business on digital platforms (owners of e-commerce trading floors, carriers, payment intermediaries, agents of foreign suppliers without permanent establishments in Vietnam, advertising media units,...) right from the planning stage to the implementation of the inspection, thereby collecting information of organizations and individuals doing business on the e-commerce trading floor for tax administration.

In particular, strengthen compliance supervision for organizations and individuals selling goods, receiving commissions from advertising in sales livestream activities on e-commerce floors.

If the review detects signs of violation of the tax law, the tax authority must make a list of individuals and organizations showing signs of violation. After that, the tax authority will transfer the dossier to the Police for investigation and handling when detecting tax evasion of individuals, organizations and business households in sales livestream activities.

Hang Du Muc was miserably drowned by her "missing sister" Quang Linh, which didn't make up for Thuy Tien's beauty  Quỳnh Quỳnh10:36:11 23/05/2024Both are famous people on social network TikTok. After having a livestream together, Quang Linh Vlogs and Hang Du Muc are getting more and more attention. The recent meeting of two sisters in Vietnam has attracted attention from netizens.

Quỳnh Quỳnh10:36:11 23/05/2024Both are famous people on social network TikTok. After having a livestream together, Quang Linh Vlogs and Hang Du Muc are getting more and more attention. The recent meeting of two sisters in Vietnam has attracted attention from netizens.

3 | 1 Discuss | Share

3 | 1 Discuss | Share

3 | 1 Discuss | Share

1 | 1 Discuss | Share

1 | 1 Discuss | Share

3 | 1 Discuss | Share

1 | 1 Discuss | Share

1 | 1 Discuss | Share

4 | 1 Discuss | Share

4 | 1 Discuss | Share

4 | 1 Discuss | Share

1 | 1 Discuss | Share

2 | 1 Discuss | Report