Zhong Shanshan - Billionaire "turning water into gold" orphaned parents, dropped out of school early, had to work as a housemaid

2 | 0 Discuss | Share

Once ranked as Asia's fourth-richest in 2015 according to the Bloomberg Billionaires Index with a fortune of $27 billion, Pan had an "unstoppable plunge" that made his fortune evaporate quickly.

Chinese real estate businessman Pan Sutong used to be named the richest group of "four giants" in Asia. However, in just five years, Mr. Pan fell into deep debt. At the top, billionaire Pan suddenly "falls off his horse". Goldin Financial Holdings' stock price plummeted, causing his fortune to evaporate quickly. With most of his assets frozen, Mr. Pan disappeared from the list of the world's 500 richest people.

Billion dollar debtor

Once ranked as Asia's fourth-richest in 2015 according to the Bloomberg Billionaires Index with a fortune of $27 billion, Pan had an "unstoppable plunge" that made his fortune evaporate quickly.

After his shares in Goldin Financial Holdings plummeted and most of his assets became mortgaged, he was dropped from the ranking of the world's 500 richest people.

Pan's initial fortune did not come from real estate but from business and later electronics manufacturing, an area he ventured into after moving from California to Hong Kong. In California, as a teenager, Pan spent most of his time skipping school and hanging out at his family's Chinese restaurant chain.

In 2008, Pan turned to investing in real estate. A few years later, the booming real estate craze in Hong Kong created countless fortunes for many people and turned it into one of the most expensive real estate markets in the world.

Now, Pan and other investors - who borrowed "excessively" during the hot real estate development period for business - have become bankrupt due to the impact of the worst recession in history. Hong Kong history. The Covid 19 pandemic and civil unrest are the cause of this situation.

Among them is Tang Shing-bor, a veteran investor known as "Shop King" for owning a huge amount of retail real estate. He is also looking to sell off billions of dollars of real estate.

A group of investors paid $5.2 billion for The Center in the purchase of the world's most expensive office building, but failed to do business when the real estate market stalled over the past year.

Edward Chan, a credit analyst at S&P Global Ratings in Hong Kong, said: "Foreclosures are rare. If foreclosures happen, the company must be in a very bad financial position. currency, with high debt and leverage".

Pan and Goldin Financial took on approximately HK$38 billion ($4.9 billion) in debt between May 2017 and September 2020 for four properties in Hong Kong, according to exchange filings and data. Stock exchange compiled by Bloomberg. The company's filings from last month also show that at least $1 billion of that debt remains unpaid and belongs to Goldin.

The latest available figures show that Goblin's net debt/EBITDA ratio was about 9 times at the end of 2018. While this figure of Sun Hung Kai Properties Ltd was only 2.3 times at the end of 2019 and 2 times. times for the small real estate company HKR International Ltd.

Even a $1.1 billion loan in September from CK Asset Holdings Ltd., backed by Hong Kong's second-richest person Li Ka-shing, was not enough to help Goldin Financial.

According to Debwrite's information in August, the loan is for an affiliate of Goldin, which owns the Goldin Financial Global Center office tower, to pay off a debt of HK$3.4 billion from its central parent company. time.

The road from the pinnacle of wealth to indebtedness

Pan moved from manufacturing consumer electronics such as cell phones and MP3 players to real estate in 2008, when he renamed the electronics company Goldin Properties Holdings Ltd. and bought a listed company, named Goldin Financial. Goldin Properties was delisted in 2017 and Pan owns a controlling stake in both companies.

The collapse of Goldin Financial can be traced back to Pan's strategy of splitting asset ownership between the company and Pan's personal interests.

Between 2011 and 2020, Pan and Goldin Financial purchased a commercial center and two residential properties. Goldin Financial holds a 60% ownership stake, while Pan ultimately holds a 40% private equity stake. A similar ownership structure for the majority stake in the company's third lot.

But starting in 2018, Pan wants full ownership of one of the residential properties and a majority stake in another property located in Kowloon's prestigious Ho Man Tin neighborhood and offering potential. good profit.

In return, he sold his shares in the remaining two assets to the company, including a 40% stake in the Goldin Financial Global Centre, the company's flagship office tower, and an expensive plot of land near Kai Airport. Tak.

So Pan became the sole guarantor of a HK$7.19 billion loan for one of the residential developments. At least four banks involved in the loan did not agree to the terms of the agreement. This makes it difficult for Goldin Financial to meet further credit lines.

The Kai Tak project then failed. At the end of 2019, Goldin Financial could not get finance by taking a bank loan to invest in the development of the land. The company then sold the land for about HK$3.5 billion, less than half what it paid for the land in 2018.

Meanwhile, the Goblin's skyscraper became a key asset to Pan's creditors after Goldin Financial failed to pay its debts. And in July, creditors of the HK$3.4 billion loan demanded that Pan repay the debt immediately, while holders of the HK$6.8 billion senior bond Kong threatened to take over the office building, which was used as a mortgage.

The bondholders then applied to the Hong Kong High Court and were approved to take control of the 27-story building. By September 2020, they were granted ownership of the building. Since then, the two sides have signed an agreement to sell the building after months of bidding.

According to a report released on January 10, Golbin said the sale of the building was enough for the company to pay off the loans and pay off the bonds. The company's board of directors also believes that, after the transaction is completed, the legal procedures related to bonds and loans "will be resolved peacefully".

The sale will put Goldin Financial in a "contrarian" situation as it transitions from a landlord to tenant position while the building previously housed the company's headquarters.

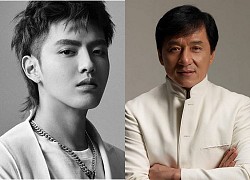

Ngo Diep Pham and the super-powered backers, "older brother Cbiz" Jackie Chan is also involved  Hà Hà12:30:13 23/07/2021Currently, Chinese showbiz wobbles in the sea of scandals of Ngo Diep Pham. The shocking details about the male singer's private life, chaotic love life and scandals in the past are constantly being stripped naked. The former EXO member is a showbiz darling, whose career is so...

Hà Hà12:30:13 23/07/2021Currently, Chinese showbiz wobbles in the sea of scandals of Ngo Diep Pham. The shocking details about the male singer's private life, chaotic love life and scandals in the past are constantly being stripped naked. The former EXO member is a showbiz darling, whose career is so...

2 | 0 Discuss | Share

3 | 0 Discuss | Share

3 | 0 Discuss | Share

4 | 0 Discuss | Share

2 | 0 Discuss | Share

5 | 0 Discuss | Share

5 | 0 Discuss | Share

5 | 0 Discuss | Share

3 | 0 Discuss | Share

3 | 0 Discuss | Share

5 | 0 Discuss | Share

2 | 0 Discuss | Share

5 | 0 Discuss | Report